After nearly fourteen years of a devastating civil war, foreign aid is needed if Syria is to have any reasonable hope of reviving its shattered economy and rebuilding its infrastructure. Years of war have turned cities into ruins, emptied villages, and made the narcotic captagon the country’s primary export. The country’s official GDP has plummeted by 54%, and 90% of the population now lives below the poverty line. Although the European Union has already agreed to send a diplomatic mission to Syria, the new government in Damascus will face an uphill battle when it comes to securing foreign funding and getting international sanctions lifted. Neither the U.S. nor European nations are rushing to engage with the newly empowered Islamists, but neighboring Turkey and Jordan may yet offer support.

Content

Poverty, darkness, and destruction

A state-sponsored drug cartel

A decade and a trillion dollars

Proceed with caution

Poverty, darkness, and destruction

The fall of Syria’s old regime was met with celebrations and hopes that, after years of brutal conflict, the country could finally begin to rebuild. The war has claimed over 600,000 lives, and half the population — 12 million people — has been displaced. Syria’s economy, unsurprisingly, has suffered catastrophic damage.

In the lead-up to 2011, when mass protests against Bashar al-Assad’s regime escalated into a full-scale civil war, the country’s GDP stood at $67.5 billion, placing it in the top half of the world table — on par with nations like Croatia, Belarus, and Azerbaijan. At the time, agriculture and oil production contributed roughly half of Syria’s GDP.

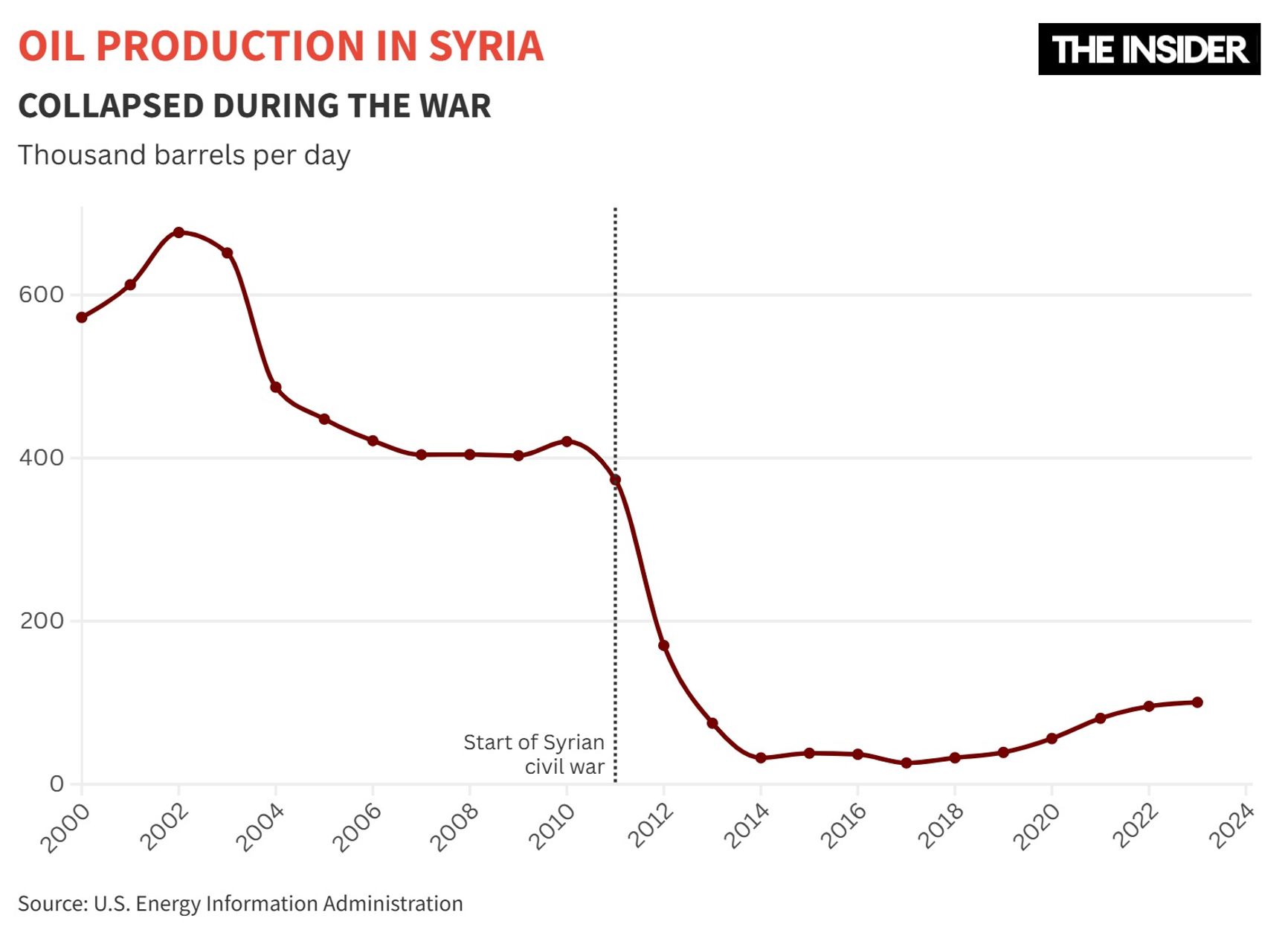

Years of war have shrunk the country’s amount of arable land, devalued its national currency, and placed oil production under the control of U.S.-backed Kurdish forces. Even the Assad regime’s figures showed that by 2022, GDP had fallen by 54% compared to pre-war levels. However, no official data has been released over the past two years, and the World Bank’s analysts have turned to alternative measures like nighttime light emissions to gauge economic activity. According to their independent estimates, the decline when compared to 2011 has been even deeper — closer to 85%.

Years of war have shrunk Syria's amount of arable land, devalued its national currency, and placed oil production under the control of U.S.-backed Kurdish forces.

Nighttime light data also revealed a 10% decline in traffic at Syrian ports in 2023, even when factoring in the activity of illegal oil tankers. The country also saw a 5.5% reduction in oil production last year alone. Syria’s oil infrastructure has been severely damaged by both war and earthquakes, while sanctions have further crippled hydrocarbons exports. Once a fairly major seller in the Eastern Mediterranean, Syria is now an importer of oil.

For ordinary Syrians, this has meant mass impoverishment. In 2023, more than 90% of the population lived in poverty, with half unable to afford food. In contrast, extreme poverty had been affecting just 1% of Syrians in 2010.

In recent years, hyperinflation has only worsened the crisis. The rate of price increases has reached 116% at a time when the Syrian currency is becoming increasingly worthless. In 2011, one U.S. dollar equaled 46 Syrian pounds; today, the SYD trades at around 15,000 per dollar. With domestic industry and agriculture in collapse, the currency devaluation has been particularly painful, as Syria’s dependence on imports — especially food — had only grown over the course of the conflict.

A state-sponsored drug cartel

With sanctions cutting off nearly all legal revenue streams, Assad’s regime turned to an alternative source of income: captagon, a synthetic drug derived from fenethylline, notorious for its quick addictiveness. Alternatively dubbed the “poor man’s cocaine” (priced at around $25 per pill) or the “drug of jihad” (for its use by militants), captagon has flooded the Middle Eastern market. Saudi Arabia remains its largest consumer.

Italian police seized Captagon tablets worth over one billion euros in Salerno.

Source: Alessandro Garofalo, Newfotosud, Napolipress / Fotogramma

According to the UK government, captagon trade generated $57 billion annually for Damascus — six times Syria’s official GDP in 2021 and ten times the state budget. “Trade in the drug is a financial lifeline for the Assad regime — it is worth approximately 3 times the combined trade of the Mexican cartels,” the UKэы government noted when imposing new sanctions against members of the Assad family involved in the cartel. This illicit trade, it added, “enriches Assad’s inner circle, militias and warlords, at the expense of the Syrian people who continue to face crippling poverty and repression at the hands of the regime.”

Despite widespread poverty and skyrocketing prices, the Syrian government had consistently raised salaries for state employees and security forces in order to maintain the regime's stability.

Selling narcotics was a financial lifeline for the Assad regime.

Captagon tablets hidden in boxes of apples were found at the Al-Qaim checkpoint between Syria's Deir ez-Zor province and Iraq's western Anbar desert region in 2023.

Source: Iraqi Customs / AFP

Assad sought control over legal exports as well, imposing strict restrictions on foreign trade and consolidating entire industries under his firm grip. Using publicly available company data, researchers were able to identify 11 individuals economically connected to the Assad family. These included the recently deceased media advisor to the president, Luna al-Shibl; the al-Bazzal brothers; notable Hezbollah financiers; regime crony Amer Foz; and five business fronts — Yasar Ibrahim, Ali Najib Ibrahim, Ahmed Khalil Khalil, Ramya Hamdan Deeb, and Razan Nizar Hmerah. Together, they oversaw a network of 19 organizations with stakes in state enterprises and government suppliers. Assad positioned himself as a major direct beneficiary of the “cannibalization of the state, the privatization of public assets, and the capture of state expenditures”, and was responsible for “further eroding distinctions between the public budget and the Assad family’s personal finances,” the researchers wrote.

A decade and a trillion dollars

Restoring Syria’s economy to its 2011 levels is likely to take at least ten years — and that’s while assuming political instability does not return. The main question remains to be answered: where will the new government find the funds to rebuild the country from literal ruins? Estimates from 2020 suggested Syria would need between $250 billion and $1 trillion for reconstruction. Given the additional destruction caused by recent earthquakes, the current figure is likely even higher. Syria’s interim Prime Minister Mohammed al-Bashir has acknowledged the magnitude of the task before him — while citing a severe shortage of foreign currency.

Syria would need between $250 billion and $1 trillion for reconstruction.

“In the vaults, there are only Syrian pounds, which are worth next to nothing,” the prime minister told Italian newspaper Il Corriere della Sera on Dec. 11. “We have no foreign reserves, and as for loans and bonds, we are still gathering the data. So yes, financially, we are in a very bad state.”

Sanctions also continue to be a significant obstacle to reconstruction. However, they are likely to remain in place, at least while the United States and others monitor the formation of a new government and discern its intentions, notes Delaney Simon, senior analyst at the International Crisis Group.

Unlike Iraq after Saddam Hussein, post-Assad Syria lacks anywhere near the requisite oil to self-finance recovery, making international support essential. However, the fact that power now rests with former field commanders and leaders of radical groups significantly reduces the likelihood of swift sanctions relief — or of large-scale aid.

Keeping sanctions in place for too long, Simon argues, “will be like pulling the rug out from under Syria just as it tries to stand.” Without easing the restrictions, investors will continue to avoid the war-torn country, and refugees will have little incentive to return.

Proceed with caution

Syria’s new government has announced plans to implement a free market economy and integrate the country into the global economic system. Its first step toward liberalization involved lifting the ban on using U.S. dollars. Assad had criminalized the use — and even the possession — of foreign currency, an offense punishable by imprisonment. The second step was scrapping the complex state regulation of imports, which had caused weeks-long delays. “Everyone who registers at the chambers will be able to import the goods they want into the market, within a specific system,” Bassel Hamwi, head of the Damascus Chamber of Commerce, told Reuters on Dec. 10.

Stability and openness are crucial to attracting investment and encouraging the return of millions of Syrian refugees, many of whom belong to the middle class. “Syria has a huge, educated, relatively wealthy diaspora which will want to rebuild the country. They could be growing double digits for years,” a senior Syrian official told Reuters on condition of anonymity.

However, the political dimension may complicate matters. Refugees, exiled Syrian businesspeople, and foreign governments remain wary of the new administration, now led by the Islamist group Hayat Tahrir al-Sham (HTS), whose origins trace back to Al-Qaeda. Many are waiting to see how HTS leader Abu Muhammad al-Julani (real name Ahmed al-Sharaa) will govern.

Doubts over HTS's commitment to property rights are already surfacing. On Dec. 8, during HTS’s offensive, al-Julani personally evicted the residents of his childhood apartment in Damascus. Accompanied by armed guards, he reportedly told the current occupants: “Would you mind vacating this apartment? You see, my parents have fond memories of this place and would like to move back.” The tenants — mechanical engineer Ahmed Suleiman and his wife — were given a few days to collect their belongings and leave the premises.

The U.S. intelligence services stopped pursuing al-Julani in 2018, former U.S. Special Representative for Syria James Jeffrey told PBS News, as HTS had become the “least bad option” among Syria’s armed factions.

Syria may find support from neighbors like Turkey and Jordan. Financial markets, often early indicators of future developments, responded positively to Assad’s fall. Turkish steel, cement, and construction stocks surged the next day, as investors anticipated Erdogan securing contracts to rebuild Syria’s major cities.

Turkey, in particular, stands to benefit by facilitating the return of 3 million Syrian refugees to their homeland. Meanwhile, Jordan — once a key trade partner for Syria — could reclaim its role as a transit hub between North Africa and the Persian Gulf, supplying Syria with fuel and other critical resources.

Western officials, however, remain cautious. “I've tasked a European top diplomat in Syria to go to Damascus to make the contacts with the new government and people there,” EU foreign policy chief Kaja Kallas announced on Dec. 16. “First we have to discuss on what level we are engaging with the Syrian new leadership,” she noted. “For us it is not only the words, but we want to see the deeds going in the right direction.”

The prospects for aid are further weakened by the unstable political situation of Syria's key supporter in the EU, French President Emmanuel Macron, who is grappling with a government crisis at home. Meanwhile, Donald Trump has shown no inclination to support Syria's new leaders, who are still designated as terrorists by the U.S.